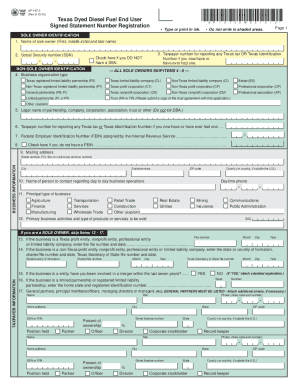

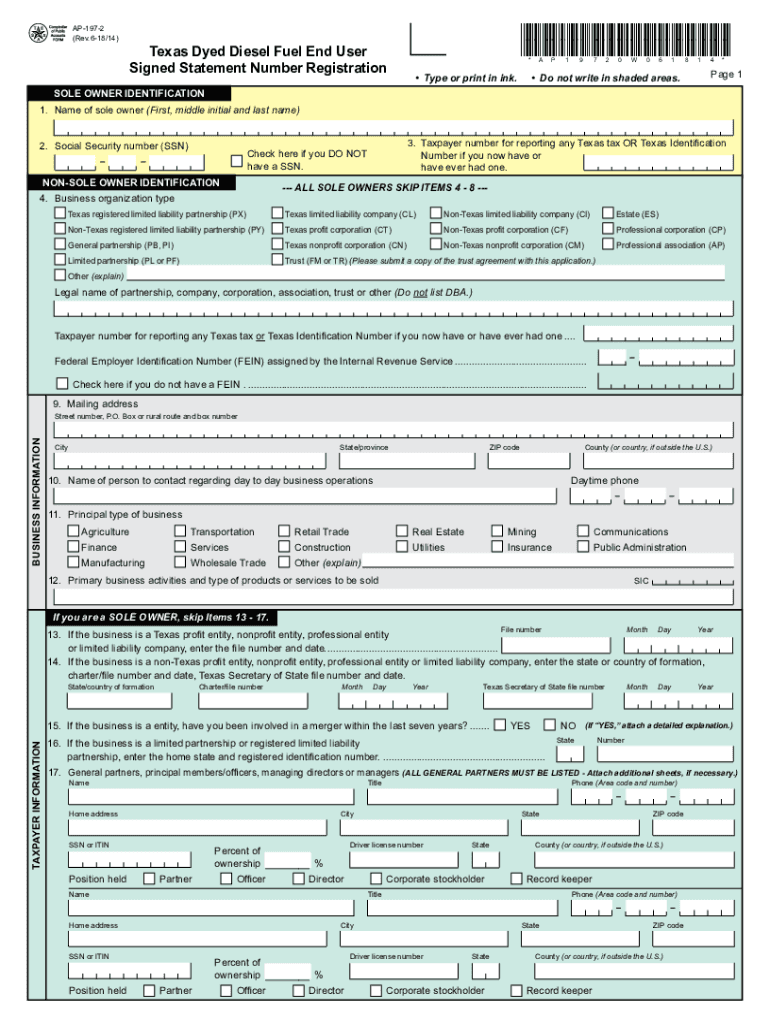

TX Comptroller AP-197 2018-2025 free printable template

Show details

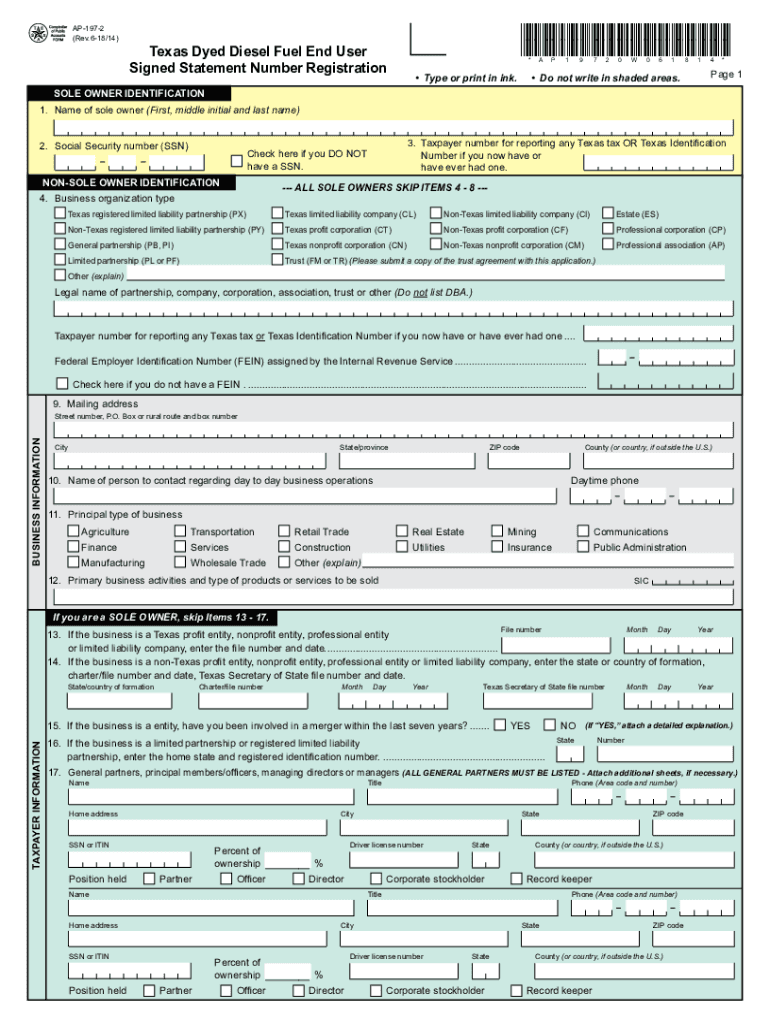

If any of the statements above are not true you do not qualify to buy dyed diesel fuel in Texas on a Signed Statement. Attach additional sheets if necessary. SIGNATURES I We declare that 1 all of the dyed diesel fuel purchased on a signed statement will be consumed by the purchaser and will not be resold 2 none of the dyed diesel fuel purchased on a signed statement will be delivered or permitted to be delivered into the fuel supply tanks of motor vehicles operating on the public highways in...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign dyed diesel fuel form

Edit your dyed diesel permit texas form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your texas dyed diesel permit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form diesel fuel online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit texas dyed diesel permit application form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TX Comptroller AP-197 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out texas red dye diesel permit form

How to fill out TX Comptroller AP-197

01

Begin with the identification section at the top of the form; provide your name, address, and phone number.

02

Specify the type of exemption being claimed under the appropriate section on the form.

03

Fill out the details of the purchases for which the exemption is being claimed, including the date of purchase and a description of the items.

04

Provide the seller's information if applicable, including their name and address.

05

Sign and date the form at the bottom to certify that the information provided is accurate.

Who needs TX Comptroller AP-197?

01

Businesses and individuals making tax-exempt purchases in Texas.

02

Organizations that qualify for a specific exemption under Texas tax laws.

Fill

dyed diesel permit texas application

: Try Risk Free

People Also Ask about texas dyed diesel tax exemption

Is dyed diesel #1 or #2?

Yes, dyed diesel and off-road diesel are stove oil. Typically a #1 stove oil or #2 stove oil, similar to diesel.

How to purchase red diesel?

Red diesel is not for general sale or for use on public roads in the majority of cases. You will need to go to a specialist fuel supplier in order to purchase red diesel legally.

What is diesel fuel dyed with?

Red-Dyed diesel – Most dyed diesel sold in the U.S. is red in color – dyed with the chemical additive Solvent Red 26 or 164. Red-dyed gas may only be used in off-road vehicles and applications, including farm tractors, heavy construction equipment, and generators.

What are the 3 types of diesel?

Each has its pros and cons for home or office energy use. Clear Diesel. The most common type of diesel oil is “clear diesel.” This is the fuel you can buy at the gas station pump. Dyed Diesel. Dyed diesel is specific to agricultural or off-road use. Diesel Exhaust Fluid.

Will dyed diesel hurt my truck?

Is Dyed Diesel Bad For Your Truck? No, this diesel is fine for your truck. The main difference isn't in the ingredients; it's in color. The red dye indicates it's for off-road use only.

Is dyed diesel the same as regular diesel?

Other than the appearance dyed diesel isn't any different from regular diesel.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my texas dyed fuel permit directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your texas dyed diesel form and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I modify texas form fuel without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your red diesel permit texas into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I edit ap 197 in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your texas state comptroller dyed diesel, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

What is TX Comptroller AP-197?

TX Comptroller AP-197 is a form used by the Texas Comptroller of Public Accounts for reporting unclaimed property. It is specifically designed to assist holders of unclaimed property in reporting and remitting property that has remained unclaimed for a specific period.

Who is required to file TX Comptroller AP-197?

Any entity or individual that holds unclaimed property, such as businesses, financial institutions, or government agencies, is required to file TX Comptroller AP-197 if their property meets the criteria for being classified as unclaimed.

How to fill out TX Comptroller AP-197?

To fill out TX Comptroller AP-197, you need to provide information such as the holder's name and address, a description of the unclaimed property, the owner's name, the last known address of the property owner, the amount of the property, and any relevant details indicating the property is unclaimed.

What is the purpose of TX Comptroller AP-197?

The purpose of TX Comptroller AP-197 is to facilitate the reporting and remittance of unclaimed property to the state of Texas, ensuring that rightful owners can reclaim their property and that businesses comply with state unclaimed property laws.

What information must be reported on TX Comptroller AP-197?

The information that must be reported on TX Comptroller AP-197 includes the name and address of the holder, a detailed description of the unclaimed property, the last known address of the owner, the owner’s name, the type of property, and the amount being reported.

Fill out your TX Comptroller AP-197 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Texas Dyed Diesel Fuel End User is not the form you're looking for?Search for another form here.

Keywords relevant to comptroller texas form ap 197

Related to diesel fuel signed

If you believe that this page should be taken down, please follow our DMCA take down process

here

.